Key features

All interactions are via public key cryptography with no backdoors or admin keys.

Vega can be deployed as a CometBFT based proof-of-stake chain.

Trading optimised fees with no per-transaction “gas” costs for orders

The protocol specs and software are open source.

Data nodes provide order book and historic data APIs.

Built in governance allows protocol users to create and manage markets.

Audits

Vega protocol is still in alpha and changing rapidly. As a result not all the code is currently audited, but where possible top quality auditors have been already been engaged to review the more stable parts of the protocol.

Solidified is one of the largest smart contract auditing firms in the world, operating since 2017 and part of the SecurityOak company.

FYEO delivers Web3 security audits, threat monitoring, AI-powered anti-phishing, and decentralized identity management.

Radically Open Security is a non-profit computer security Consultancy passionate about making the world more secure.

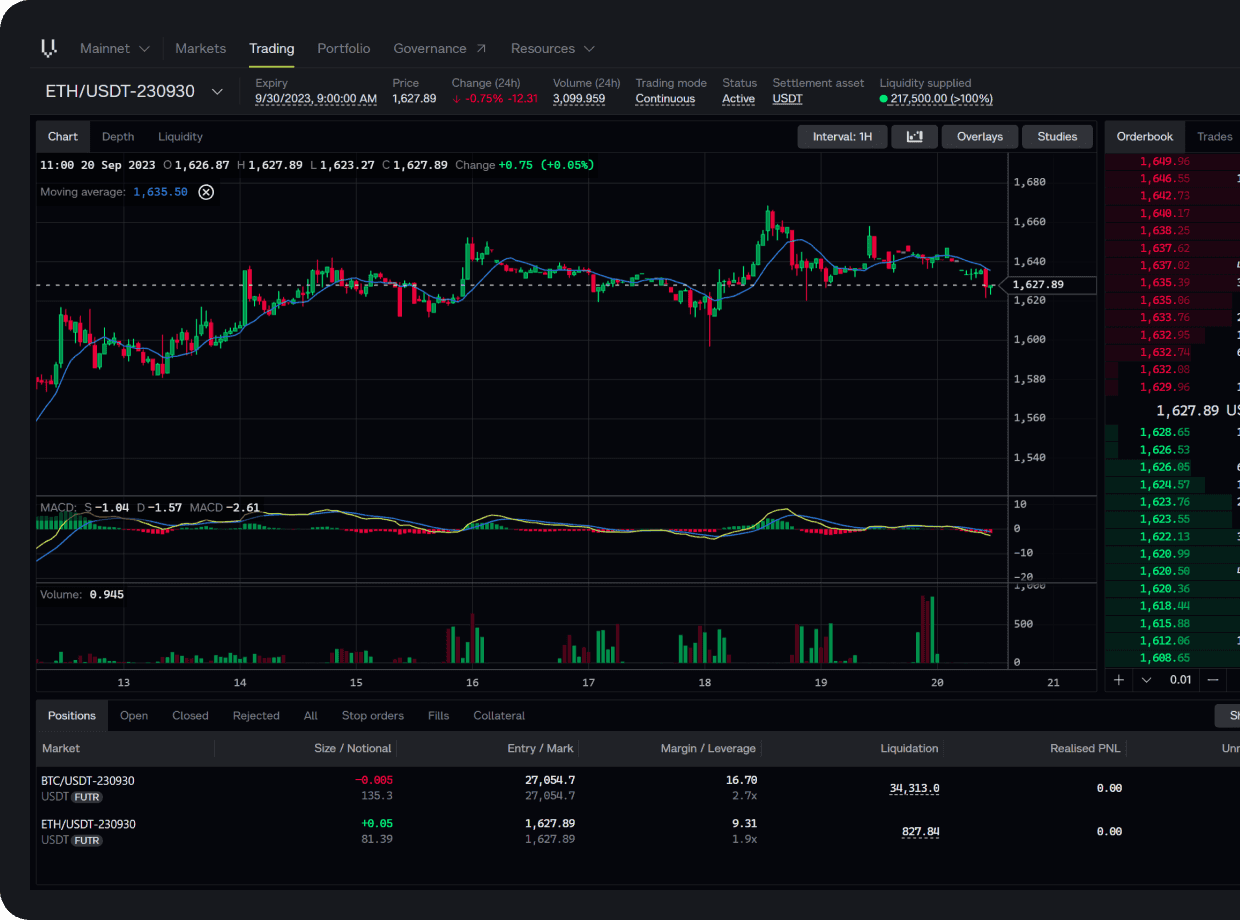

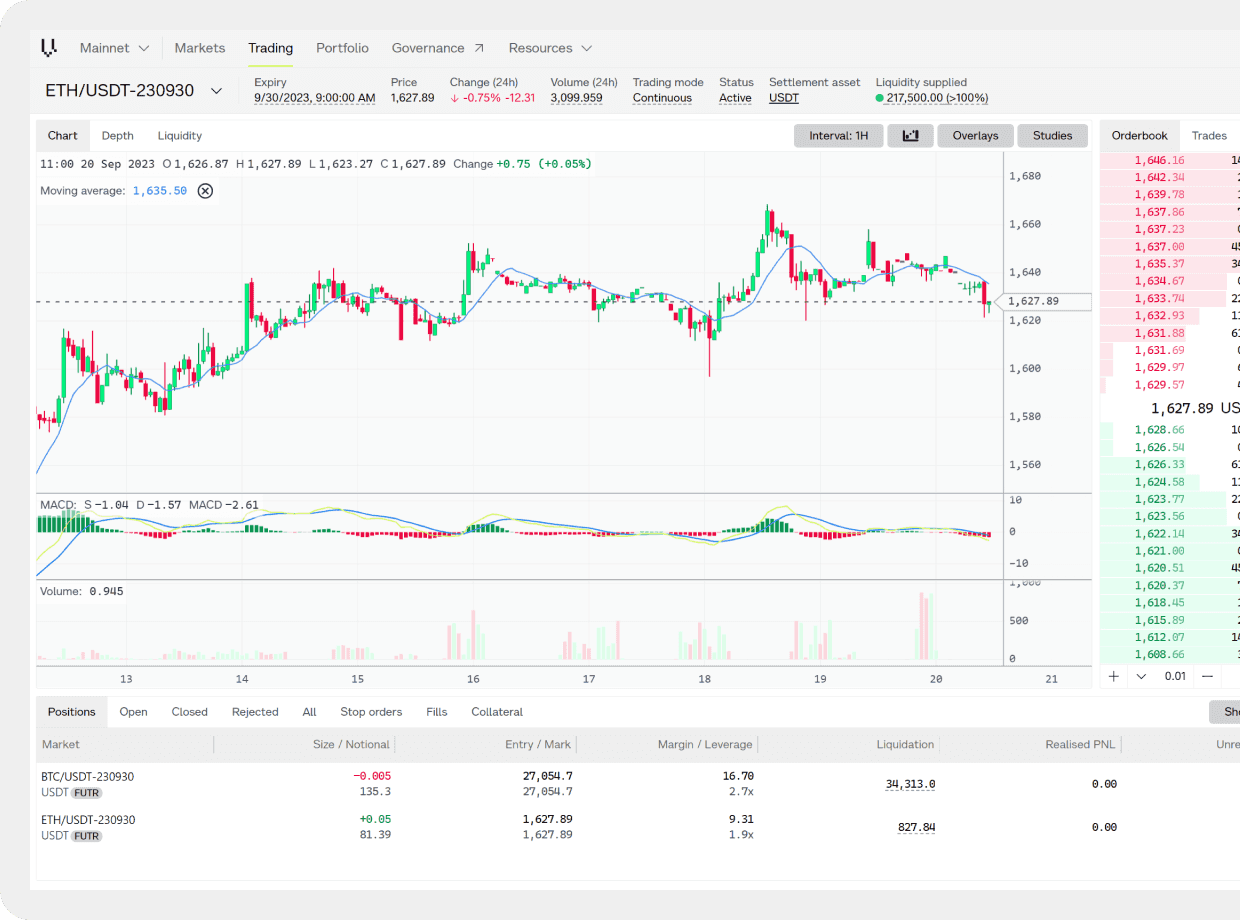

Programmatic trading on Vega

Vega's decentralised datanode architecture provides rich CEX-like APIs and full historic price data for everyone.